English judge Lord Denning once said “Cash flow is the lifeblood of the building industry,” and this rings true to this day.

Cash flow refers to the movement of income (or revenue) into and expenditure out of a business.

In the construction industry, it’s a vital concept as contractors need money to pay subcontractors, material suppliers, as well as daily operation expenses during a project’s timeline.

However, negative cash flow (when there are more outgoing costs than incoming profit) also exists within the industry and can cause various drawbacks in a project’s completion. Let’s examine the critical issues that cause negative cash flow in businesses.

The first and most prevalent cause among the others is the pervasive attitude by various parties.

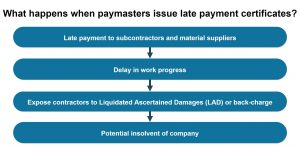

It has become an unfortunately common practice for paymasters to be late in issuing payment certificates as well as late in honoring them.

This culture has inevitably affected contractors’ cash flow and profit, creating a domino effect that goes as follows:

The second point is that contractors also often overlook the importance of payment provision in construction projects, despite the fact that it is a major concern for most if not all contractors.

The contractual provision governs the rights and entitlements of contractors to be paid, which relates back to the need for cash flow among contractors.There are two criteria needed to be met for the payment clause:

- Certification Period

- Period of Honouring Certificate

A majority of contracts tend to ignore or exclude the certification period as it relieves the contract administrator from being tied with a constraint period to make valuation and issue a payment certificate.

Even so, that is why the commonly used standard form of contracts such as JKR Contract (PWD) and PAM Contract have these two criteria to provide clarity in terms of payment for work done for the contractors.

To summarize, contractors must develop awareness from time to time regarding this matter to ensure that they will be able to receive the monetary rewards that they were promised.

Contractors should be aware of their rights contractually and legally and avoid being subjected to negative cash flow or worst still, become insolvent. It’s also beneficial as it narrows the room for exploitation of any party under a contract.

The third point is the availability and effectiveness of dispute resolution mechanisms.

Apart from the conventional litigation, there are various alternative ways often regarded as Alternative Dispute Resolution (ADR) to resolve disputes which include mediation, adjudication, and arbitration.

Mediation, for example, provides an alternative way to settle the dispute without the need to go to court. Involved parties could consider options and suggestions made by the mediator to ensure a win-win solution, as well as maintaining a personal and business relationship between involved parties.

The statutory adjudication under CIPAA 2012 was enacted and came into force on 15 April 2014 to cure this very payment problem in the construction industry. Through CIPAA 2012, a speedy and cheaper dispute resolution which considers all aspects of the situation can also be provided. Thus, the issue of late payments, pervasive negative cultures and behaviours can be overcame to avoid negative cash flow problems in the future.

The third method is arbitration which is an effective way of obtaining a final decision or award in a dispute, or a series of dispute, without needing reference from a court. It requires construction contracts to have an arbitration clause and is more informal compared to a typical court proceeding. It is, however, a private and consensual process whereby the involved parties are at liberty to decide on the arbitration terms such as the number of arbitrators, language used as well as the venue of the proceeding.

In conclusion, it is clear that there needs to be a greater understanding among contractors regarding the critical issues affecting their cash flow in business.